-

Business banking platform

-

Account featuresEasily manage your everyday financial operations with your own IBAN account

Account featuresEasily manage your everyday financial operations with your own IBAN account  Global payroll

Global payroll-

EscrowProtect your international payments using Gemba’s escrow

EscrowProtect your international payments using Gemba’s escrow -

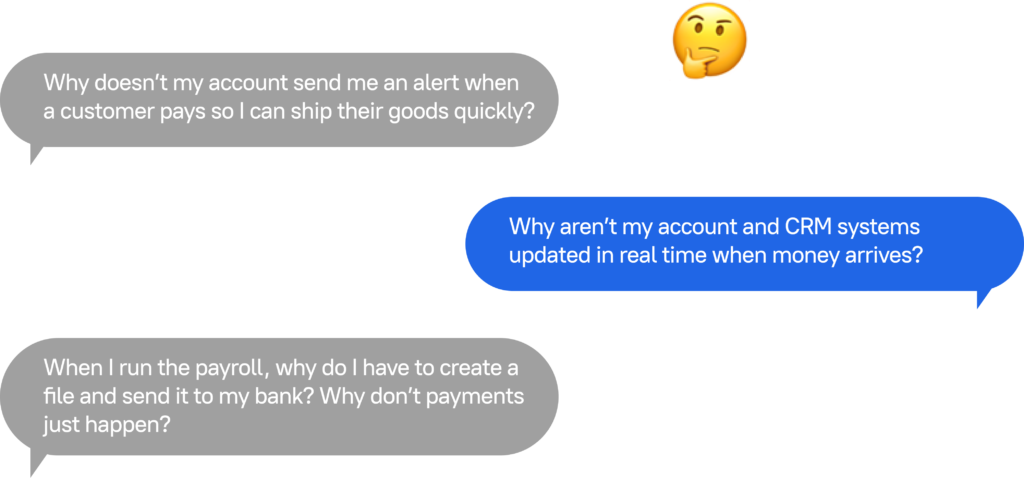

PaymentsSend and receive money internationally, issue payouts and cut transfer costs

PaymentsSend and receive money internationally, issue payouts and cut transfer costs  Seafarer account

Seafarer account-

EligibilityCheck if you are eligible to open a business account with us

EligibilityCheck if you are eligible to open a business account with us -

How to applyStep-by-step guide for account application process

How to applyStep-by-step guide for account application process  Help

Help-

Personal accounts for employees

-

Account featuresEasily manage your everyday financial operations with your own IBAN account. No branch visit needed.

Account featuresEasily manage your everyday financial operations with your own IBAN account. No branch visit needed.  Help

Help

-

-

-

Embedded Banking

-

How it worksWe’re a fully licensed UK financial institution, which means, we’re regulated by the Financial Conduct Authority

How it worksWe’re a fully licensed UK financial institution, which means, we’re regulated by the Financial Conduct Authority -

FeaturesWallet, payment account, bank account, spending account — however you think of it, payments at Gemba always pass through an account.

FeaturesWallet, payment account, bank account, spending account — however you think of it, payments at Gemba always pass through an account. -

Payment accounts via APIOur free account lets you spend, save and manage your money, all in one place.

Payment accounts via APIOur free account lets you spend, save and manage your money, all in one place. -

Use cases

-

Incorporation servicesStop introducing your clients to the bank. Bank your customers yourself.

Incorporation servicesStop introducing your clients to the bank. Bank your customers yourself. -

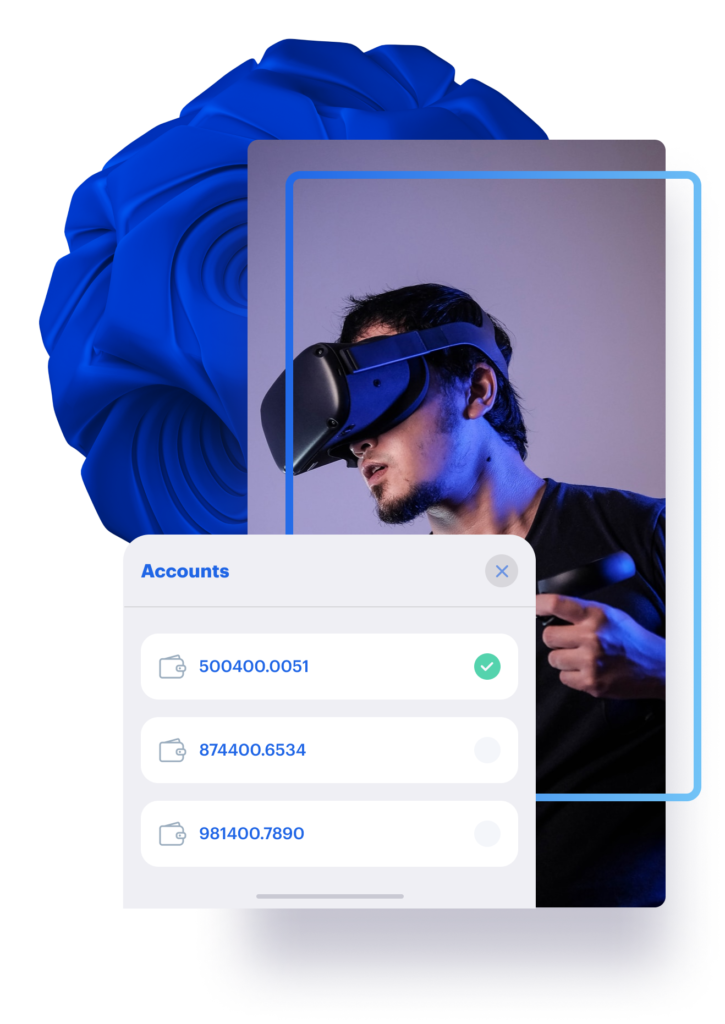

Growing businessAs an organization grows, business needs and priorities change. During these periods, working with inflexible banks is highly restrictive to growth.

Growing businessAs an organization grows, business needs and priorities change. During these periods, working with inflexible banks is highly restrictive to growth. -

Insurance BusinessGemba offers insurers a fast and easy pay-out solution, which enables you to efficiently send pay-outs to a customer’s bank account in seconds.

Insurance BusinessGemba offers insurers a fast and easy pay-out solution, which enables you to efficiently send pay-outs to a customer’s bank account in seconds. -

Platforms & MarketplacesInviting your players to deposit by Open Banking is the new way to pay, enabling a seamless risk-free automated bank transfer that is fast and secure for both player and operator.

Platforms & MarketplacesInviting your players to deposit by Open Banking is the new way to pay, enabling a seamless risk-free automated bank transfer that is fast and secure for both player and operator. -

WhiteLabel Setup GuideStart your online banking app in 3 hours White label no-code online banking manual

WhiteLabel Setup GuideStart your online banking app in 3 hours White label no-code online banking manual

-

-

- Company

© GEMBA 2024. All rights reserved | Authorized and regulated by the Financial Conduct Authority” (Reference number: 804853)

Gemba Finance Ltd.Level 39, 1 Canada Square, Canary Wharf, London, E14 5AB, UK Contact form: [email protected]